Tax Free Investing Steps

1. Individual Retirement Account (IRA)

Anyone with a taxable income can do an IRA. 12 years old, high school, college, about to retire, etc… it’s a great place to start. It takes about 10 minutes to open a free account through Fidelity, Vanguard, or a firm similar to those.

2020 IRA Max Contributions

If you’re married, you and your spouse can each have an IRA even if only one of you has an income. Therefore, you can do $12,000 per year or $14,000 if you’re both age 50 and older. You can choose to open a Roth IRA or Traditional IRA or split your $6,000 into both. There are income limits for the Roth IRA option.

2020 Roth IRA Income Limits

If you’re income is higher than the maximum you have to choose the Traditional IRA option. But you can always immediately convert it to a Roth IRA if you want to. This is known as doing a “Backdoor Roth IRA” and it is completely legal. Personally, this year I’m doing $6,000 into a Roth IRA through Fidelity. Roth means you pay taxes upfront and then never have to pay taxes again on that money or the gains that money makes. Traditional means you pay no taxes up front, so it lowers the amount of taxes you pay this year, but when you retire you will pay taxes on the money you put in and the gains.

2. Employer Sponsored Plan (ESP): 401K, 403b, 457b, TSP, “Deferred comp”

All the above mentioned plans are the essentially the same it just depends on what type of employer you work for. All of those options also have Roth or Traditional. Roth 401k has been around since 2006 and even the federal government’s version of the 401k, which is the TSP, has a Roth and traditional TSP option. Therefore, if your employer doesn’t have a Roth option yet they’re slower than the federal government, which means they’re really behind. Unlike the IRA there is no income limits on ESP’s.

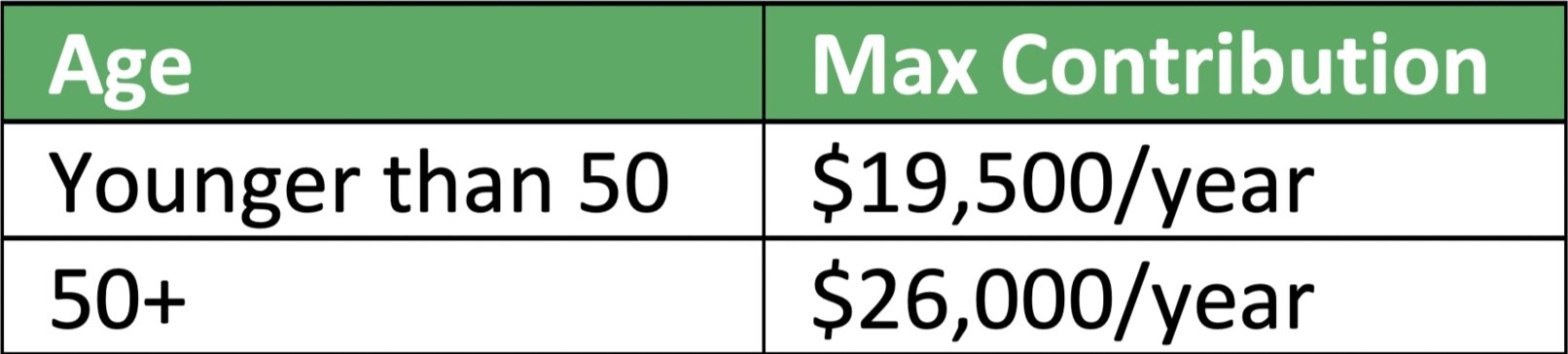

2020 401k Max Contributions

If you’re married, both working, both have your own 401k plans then you can do each do $19,500 into your own 401k’s. Personally, my employer has a 457b plan with no match so this year I’m contributing $19,500 into that plan. If your employer does offer a match, like 5% or to $3,000 of your salary then your 401k should be the first thing you invest in because the match is free money. Bonus Knowledge: Whether you chose Roth or traditional for your own contributions it doesn’t matter you will still get your employer match. But the match has to go into a traditional account.

3. Education Savings Account (ESA) or 529 plan

This is for educational expenses. That includes college for your kids, if you’re going back to school, private high school, etc. You can find a list online of qualified educational expenses. As of 2020 you can do $2,000 per year per child into an ESA until the child is age 18. Every state has their own version of a 529 plan, you can pick whatever state 529 plan you like best, and you don’t have to live in that state. Each state 529 plan has their own rules but typically the limits you can contribute are very high and you can do as much as needed. The big difference between an ESA and 529 is you can put more into a 529 and there is no age restriction, unlike an ESA you can only put money in the account until the child turns 18 unless the child has special needs. A 529 doesn’t have to be for your child it can be for you. If you want to go back to school and get a degree or get your masters.

The great thing about Education Savings Accounts and 529 plans is the tax advantages are even better than retirement plans. Your contributions are tax deductible to an ESA or 529, it grows tax free, and when you pull it out its tax free as long as you use the money for qualified education expenses. Personally, I don’t have any kids, but If I want to go get master’s degree, I will most likely take advantage of a 529 plan in addition to using my GI Bill.

4. Health Savings Account (HSA)

Note: There is also a “529 ABLE” for a disabled person.

2020 HSA Max Contributions

In order to have a Health Savings Account you need a High Deductible Health Plan (HDHP). Sometimes when you have HDHP through an employer they may contribute a certain amount automatically to your HSA. Personally, my employer does $500 a year into my HSA.

5. Brokerage Account

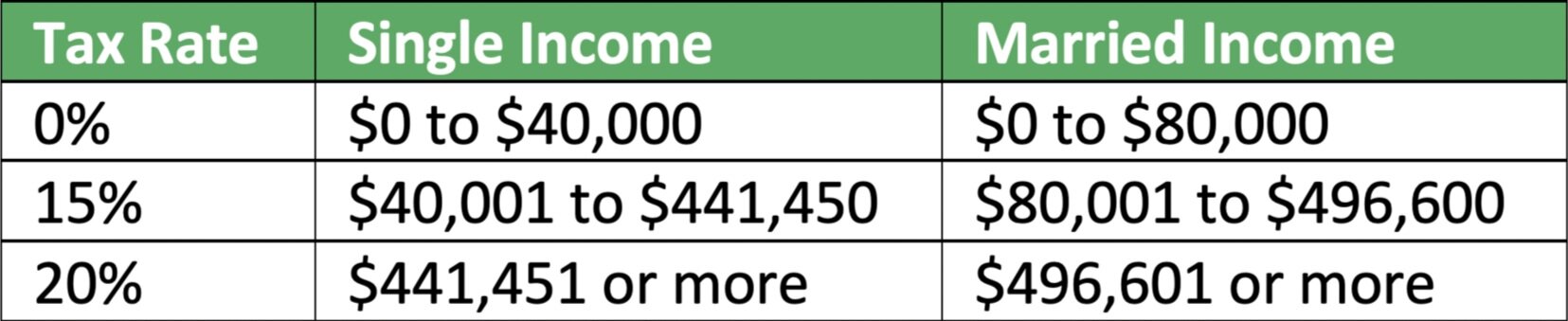

This can be opened through any firm such as Fidelity, E*TRADE, or Charles Schwab. Sometimes referred to as a bridge account to “bridge” the gap from when you retire early until you reach age 59 1/2. Why age 59 1/2? Because this is the age you need to be in order to withdraw money from your IRA or 401k without penalty. People that max out their IRA’s and 401k’s and have money left over or people that want to retire early can open up a regular brokerage account and start investing. The tax benefit to this isn’t as good as an IRA or 401k but there is still an advantage. As long as you own a stock or fund inside this account for more than one year the gains on the investment are no longer subject to your regular income tax but rather what’s called “long term capital gains tax”. The amount of tax you pay varies on your income.

2020 Long Term Capital Gains Tax Rates

Personally, I have an E*TRADE brokerage account. I have used this in the past to save up for the down payment on my house but now I have moved most of that money out. Eventually I’ll move money back there to use as a bridge account.

6. Start Your Own Business

Investing in your own business has huge tax advantages. This may be a step above investing as a beginner because it takes more time. You can start a business by choosing a Sole Proprietorship, LLC, or Corporation. In a business you only have to pay taxes on profits. Therefore, if your business makes $50,000 and you have $50,000 worth of business-related expenses you don’t pay any taxes that year ($50,000-$50,000=$0). Whether you want to invest in real estate or start a small work from home business, you should be taking advantage of this as long as you go about it safely and smartly. Personally, this year I’m operating a sole proprietorship.