How to Budget

How to Make a Budget for Beginners

A budget is crucial to putting you on a path to succeed financially. This is your foundation. You need to know what money is coming in and going out. How many of us get to the end of the month and you wonder, where did all my money go? A budget is going to help give you control of your money.

What a lot of people do and what I used to do is only look at “I’m bringing in about this much money per month” and “I’m spending about this much money per month”. As long as I bring in more than I spend and my bank account stays above a certain number, “I’m good right?”

That’s only going to be enough to stay afloat. We want to do a lot more than stay afloat, we want to be wildly successful with money because we can. When you do a budget, I guarantee you will be surprised by how much you spend on certain things. For me I was shocked at the amount of money I spent on groceries and going out to eat every month.

A Budget Can Give You Freedom

A lot of times people think of budgets as very restrictive. Especially if you’re like me and you’re a natural spender. People think because I talk about personal finance that I’m super frugal, ‘save every penny’ kind of guy but I’m actually not. I love spending money on things. It makes me happy! But what a budget actually does is gives me permission to spend. If I budget $200/month on entertainment, I just gave myself permission to spend $200 that month on entertainment and not feel bad about it because I know it fits in my budget! A budget can actually give you more freedom.

Where to Start the Budget

Budgeting has also never been easier than it is today. There are budgeting apps you can use for free. I use the app Every Dollar. I’m not getting paid to say that either, I just think it’s the best budgeting app right now. It’s completely free to download and use. You can pay for an upgraded version if you want to link your bank accounts, personally I don’t. Usually what I do is at the gym I’ll open up my Every Dollar app and my banking app. In about 2 minutes I’ll plug in my expenses for the last day or two. It’s that simple to keep track of everything. If you want to do something more handwritten, I put a link below for a cheap budget planner.

Or a third option- you can create an excel spreadsheet and print it out at the beginning of each month and fill out your expenses as you go.

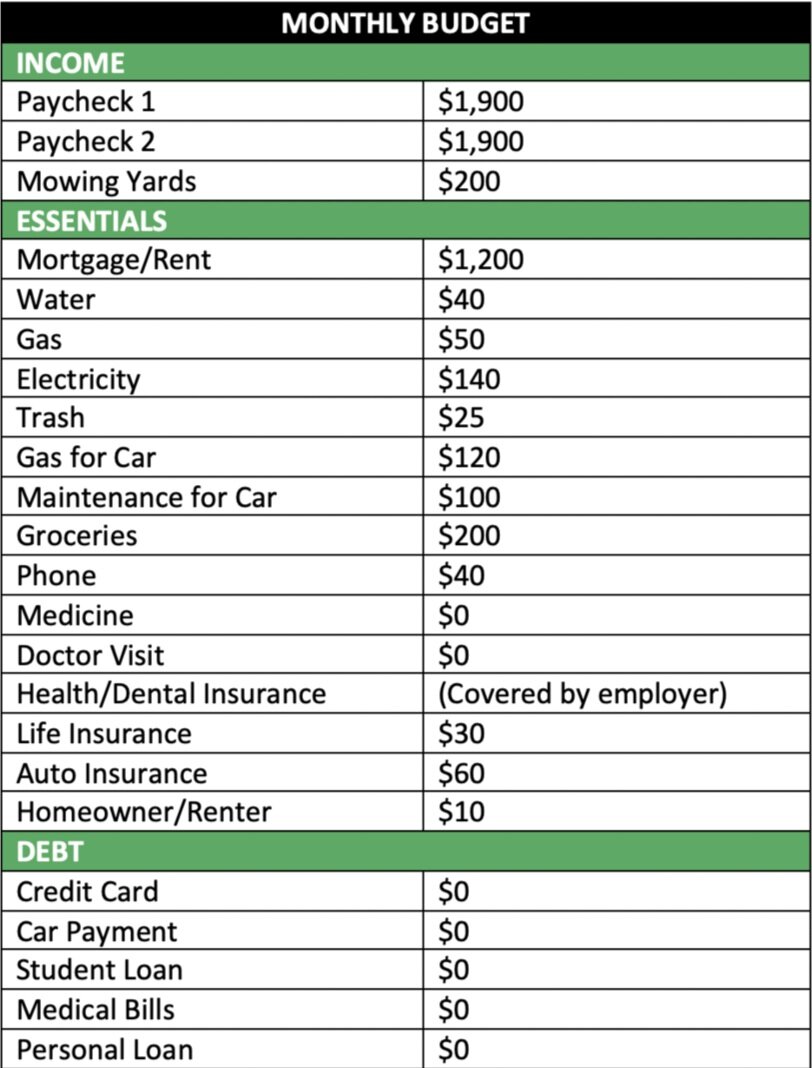

There are two parts to a budget. What’s coming in and what is going out.

First part is income. Money that comes in the form of your salary, bonuses, commissions, overtime, side hustle, etc. First thing we need to plug into your budget is how much you’re going to get paid this month. Input your paychecks after tax (AKA “take home” or “net” pay).

Second part of the budget is outgoing things. Such as expenses, investments, savings, etc.

1) ESSENTIALS

First start with the ESSENTIALS. Mortgage/Rent, Groceries, Electricity, Water, Gas for your car, Phone bill, Insurances (Auto, home/renters, life, health/dental insurance). Things that need to be paid so you can survive. Your income needs to be able to cover these expenses, if it can’t then you need to hustle to get more income ASAP.

2) DEBT

Second is DEBT payments (personal/consumer debt). Student loans, Car loans, credit card debt, Medical bills, furniture loans, etc. All debt except mortgages.

3) GIVING

Whether you give to charity, tithe to a church, give to a local nonprofit, or buy a gift for someone.

4) INVESTING

Then move to INVESTING. IRA, 401k, TSP, 403b, 457b, whatever retirement plan you have. I recommend a minimum 15% of your salary going towards investing every month.

5) SAVINGS

If you don’t have an emergency fund, “rainy day fund”, you need one ASAP. It should be 6 months of expenses. This should be somewhere easily accessible but only touched in a real emergency situation. Once you’ve built the emergency fund you can move on and focus on other savings funds. Create savings funds or what some people call “sinking funds”. This is a fund where you are going to pile up extra money for vacations, next car purchase, house down payment, house renovations, college fund, etc... Have goals in mind for your savings account. Being intentional will make you wealthy. Don’t pile up money in your savings account with no assignment for it. If you have a pile of money in your savings account and no goal for it, it tends to get spent on useless things and its extra money that could have been invested. If your money is going to sit somewhere for a while, make it work for you. Let it sit invested in a place that is going to make you money.

6) OPTIONAL EXPENSES

Restaurants, clothing, hair/cosmetics, subscriptions, memberships, entertainment, etc. These optional expenses are called optional because it’s things you don’t need to survive. It’s going to be the first place we sacrifice if we need money somewhere else in our budget . Example: Groceries end up being $50 higher this month. In order to compensate for that we’ll pull $25 from clothing and $25 from entertainment to cover.

Miscellaneous: This is your catch all category. Random things you buy on Amazon or at the store. But if you notice you’re buying the same thing every month make a separate line item for it. This category is only for unexpected expenses, it is not designed to be a “Target Shopping Fund”.

Average Joe’s Monthly Budget:

*This Budget serves as an Example only

We want to have $0 left when we’re done creating our budget. This is called a zero-based budget. Meaning every dollar you make has an assignment to it.

If you are in the negative, in other words you ran out of money before this point then you’re living above your means. You’re spending more than you make which leads to stress and disaster. You need to go back but don’t lower your retirement investing, first lower the optional expenses such as your subscriptions, purchases, or travel money. And/or figure out a way to bring in more income.

What to do with any money left over? This is a good thing. This is called living below your means.

Extra money left over should go to these categories:

1. Debt: The more you throw at your debt = the quicker you pay it off = less interest you’ll pay and the sooner you can stop giving away part of your income every month to a bank. Which also means more money for you to invest and spend on fun things! This includes paying off your house. Pay extra money on your mortgage, just because you took out a 30 year mortgage doesn’t mean you have to take 30 years to pay it off. On a $300,000 - 30 year - 3% mortgage you’ll pay $155,089 just in interest. Get out of that!

2. Investments: You can’t go wrong with investing more. Or putting more into a savings fund that has an assignment, like a vacation fund or saving up for a car.

3. Optional Expenses. Spend more money of fun stuff. You earned it. Go out to eat more, go to nicer restaurants or buy better wine.

Personally, what I do with the money I have left over since I have no consumer debt anymore, I put extra towards my mortgage because I want to own my house ASAP. As well as I put more into retirement investing because I want to retire early and live better off than I live now. Anything other money left over means I spend more in fun categories that month.