The Power of Compound Interest

The difference between investing early vs later shows the power of compound interest and why you should be taking advantage of compound interest immediately…. Like right now! Albert Einstein said this about compound interest,

“Compound interest is the greatest mathematical discovery of all time”.

Why would you not participate in the greatest mathematical discovery of all time?

Compound Interest Explained

For example, let’s say you had $0.01 and it doubled every day for 30 days. The 2nd day you would have $0.02, the 3rd day you would have $0.04, the 4th day you would have $0.08. Which doesn’t sound like a lot yet because compound interest is always a slow start. At the end of 30 days you would have $5,368,709.12. Obviously, there’s no investment that will double your money every day but that shows you the power of compounding. But let’s look at the stock market, which is an investment easily accessible to every single person. On average the stock market returns just over 10% per year (10.7% based on the S&P 500 since its inception). Look at what happens when you invest $1,000:

Keep in mind this example includes adding no additional investments to your initial $1,000! Even though the first year you make $100 the second year you don’t just make $100, you make $110. Because now your interest is gaining interest. That’s called compound interest.

Albert Einstein said, “Compound interest is the 8th wonder of the world. He who understands it, earns it. He who doesn't, pays it.”

There are 2 different types of people in that quote. The person who understands it, builds wealth. The person who doesn’t try to understand it stays broke.

One of my favorite sayings is “Give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime”. Again, we see 2 different types of people. Some of you need to stop buying fish and start being fisherman! The broke person continues to pay a fisherman because they don’t want to invest in a fishing pole and take the time to learn to fish. To build wealth you have to put yourself on the other side of the equation. You have to realize the more money you borrow the more compound interest you’re paying.

I see people who have $20,000 in the bank go take out a loan and finance a $20,000 car. You are literally giving the bank your own money and letting the bank give it back to you with penalty (interest). Stop being the broke person and force yourself to be on the other side of the equation.

This is a key to why the rich get richer and the poor get poorer. Rich people keep stacking the odds in their favor. Poor people keep stacking the odds against them. You have to get over the pain of buying a fishing pole and teach yourself to fish. In other words, stop buying the eggs and start saving to buy the Hen. The Hen will make you more eggs than you ever could have bought.

Investing in your 20’s, 30’s, 40’s, & 50’s

If you invest $500/month with an average return on investment (ROI) of 10%. What happens when you do this until age 60?

Can the average person really do this?

But yet the average amount of savings a 60-year-old has $172,000 saved!

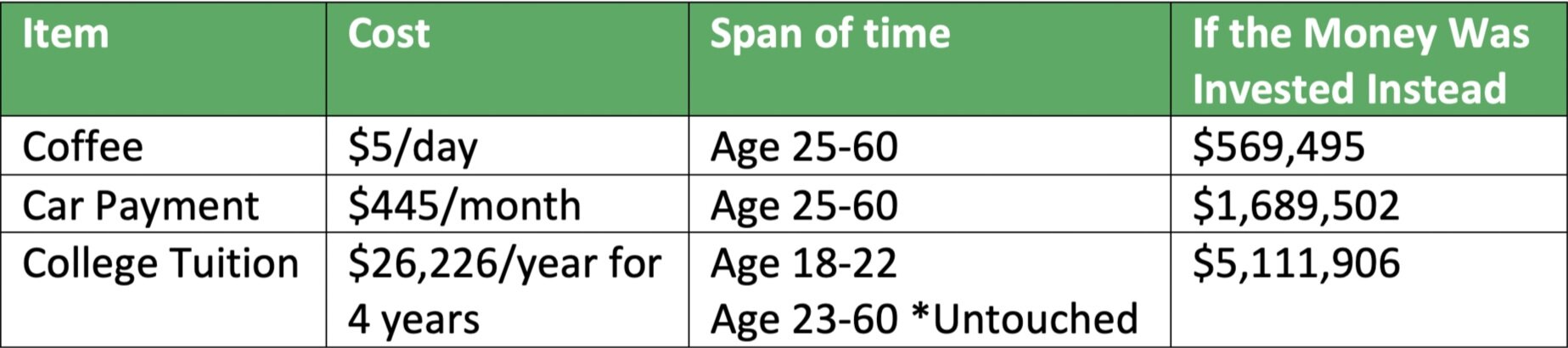

It’s not about not buying coffee or cars it’s about buying better coffee and better cars later in life. We want to get off of the chart that goes up when we make money and equally down when we spend money. We want to be the chart that gradually increases. Even though we buy things along the way, we never stop increasing. It’s about creating a life that at some point is self-sustainable where the wealth that you have pays for the life that you want.

Take Action

1st, we must plan to get there by starting a budget and investing. Check out my “How to Make a Budget” article. 2nd, we must plan to get there sooner by raising our income and making better investments.

I am tired of hearing that high levels of wealth are inaccessible to the lower and middle class. In about 10 minutes anyone can open an account online that will give you access to the 8th wonder of the world, compound interest! Check out my article here on what accounts to utilize to get started investing.

If you’re hungry for more information like this check out these two books I highly recommend: