Roth IRA Explained

Anyone with a taxable income can do an Individual Retirement Account (IRA). You can choose traditional IRA or roth IRA. These accounts are very easy to set up through a company such as Fidelity, Vanguard, or Charles Schwab.

Roth IRA means you are contributing “after tax” dollars. As of 2020 you can contribute:

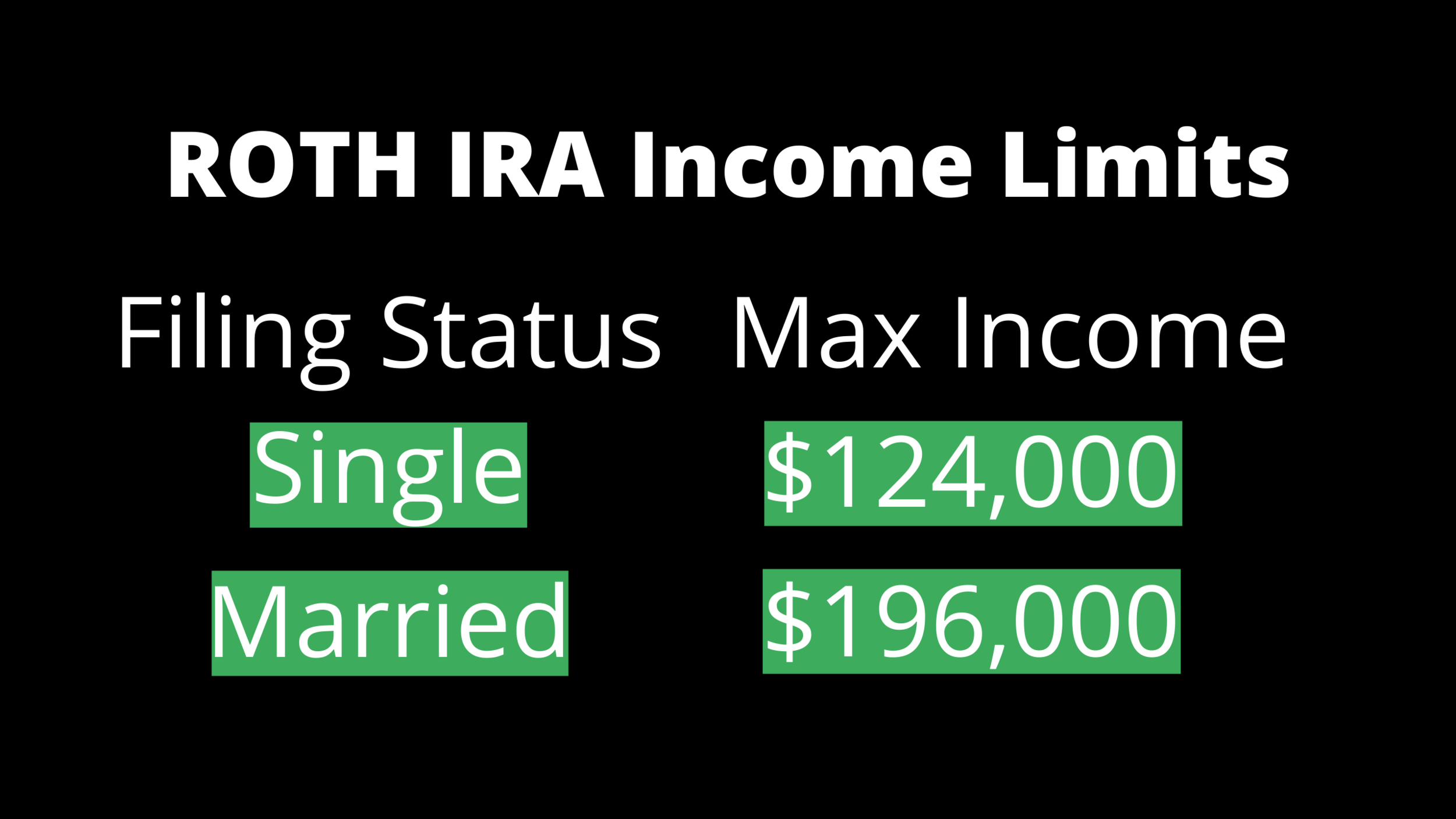

You can do $6,000 as a lump sum anytime during the year or you can contribute on a scheduled basis, such as $500/month. However, there are income limits for a Roth IRA (2020):

If you’re income is higher than those maximums you have to choose the traditional IRA option. But you can always immediately convert it to a Roth IRA if you want to. This is known as doing a “Backdoor Roth IRA” and it’s completely legal.

What can you invest in with a Roth IRA?

Within your IRA account, there will be thousands of investment options to choose from; stocks, bonds, ETFs, index funds, mutual funds, among others. If you’re not sure where to start, I recommend you sort the mutual funds and index funds by highest rate of return over 10 years. Pick a few of the top earning mutual funds or index funds to invest in.

5 HUGE Roth IRA Benefits

1. Withdraw Your Contributions At Any Time

Roth IRA allows you to withdraw your own contributions at any time with no taxes and no penalty! Because it’s your money that you already paid taxes on. As long as your Roth IRA account has been open for 5 years or longer. This is great for someone who wants to retire before the age of 59 ½. Let’s say you have 1 million in a traditional 401k and 1 million in your Roth Ira. You retire at age 55. You can’t touch your traditional 401k before age 59 ½ or you will be penalized. However, you can begin to withdraw your contributions from your Roth IRA and live off that income until you reach age 59 ½.

2. Avoid Tax Increases

Did you know tax brackets are historically low right now? The majority of Americans pay 0%-15% income tax. In 1952 there was a 92% tax bracket! That’s an insane amount of money to pay the government. I don’t think taxes will ever be that high again, but America is in a massive amount of federal debt (27 trillion and counting). By investing in a Roth IRA, you avoid any risk of taxes becoming higher because you’ll never have to pay taxes again on that money.

3. Large Withdrawals

The 3rd huge benefit to having a Roth IRA is if you make large withdrawals to pay for big purchases during retirement. What if you want to pay off your house, buy a rental property, a boat, car, or nice vacation? If you withdraw large sums of money from traditional IRA or traditional 401k you will get hammered on taxes. Because you are taking out a large amount of money in a single year you may bump yourself into the next highest tax bracket. For example, you want to buy a $300k rental property: If you have a Roth IRA you would just take out $300k and pay for it, no taxes to worry about. If you have only Traditional accounts, you would have to pull out upwards of $476,190 to pay for a $300k purchase because your big withdrawal is heavily taxed.

4. No Required Minimum Distributions (RMDs)

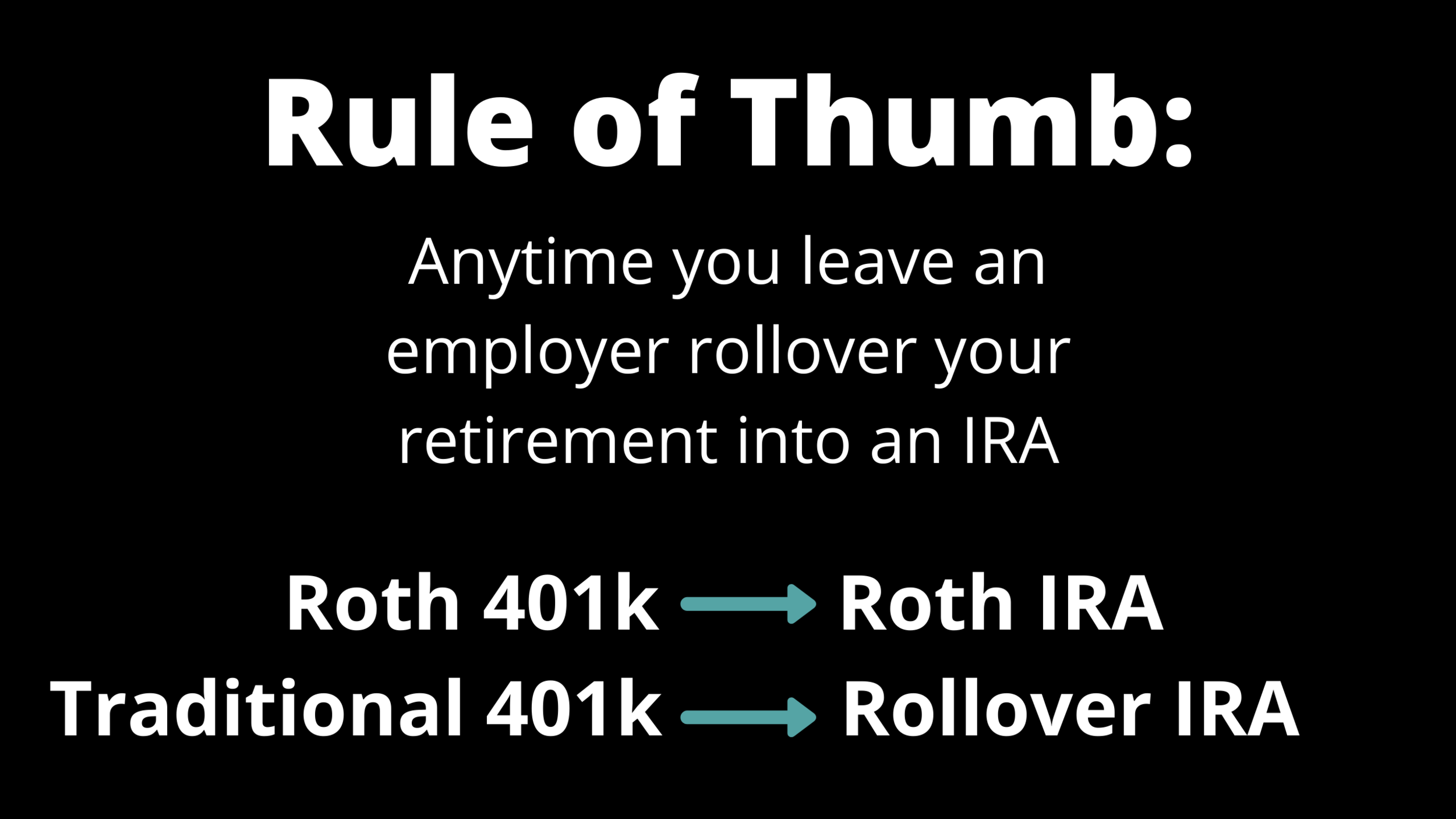

No RMDs. All retirement accounts except for Roth IRA’s have RMDs. That means a 401k, 403b, 457b, TSP, and Traditional IRA have RMDs. Starting at age 72 you’re required to pull out approximately 4% and then it increases every year after that. At age 85 the RMD is almost 7%. Which means with RMDs you’re going to have a hard time trying to keep up with inflation the older you get. Good Rule of Thumb: Every time you leave an employer roll over your funds into an IRA. Your traditional funds go into a Rollover IRA and your roth funds go into a Roth IRA that will have no RMDs!

5. Tax Free Inheritance

The 5th and final huge benefit to a roth IRA is the wealth you leave behind to your loved ones. According to the IRS, your beneficiary has 10 years to pull out all the money you leave behind when you die. If you leave behind a large sum of money it will put your beneficiary in a drastically higher tax bracket, then their current one. Whereas with the Roth IRA, your loved one can withdraw the money at any time tax free. Ex: You leave behind $1million. If it’s $1million in a roth IRA the beneficiary takes home $1million. If it’s in a traditional account, after a 37% tax the beneficiary only takes home $630,000.