New vs Used Car

Is it Better to Buy a New or Used Car?

6 factors that need to be taken into account: Sales price of the car, Sales tax, Insurance, Maintenance, if you Finance a car, and Depreciation. Depreciation means the older your car gets, the more it goes down in value. Did you know a new car loses 10% of its value after 1 minute and 20% of its value after 1 year? Then a car depreciates about 15% per year for the rest of its life.

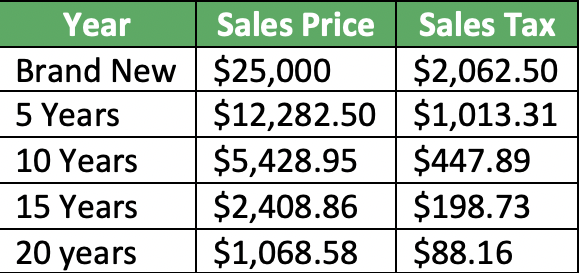

#1 & #2: SALES PRICE and DEPRECIATION

These first two factors determine what you’re going to pay for the car and what is it going to be worth when you sell it. For this ENTIRE article we will use a $25,000 Brand New car as the example.

This is the prime example of depreciation. The car starts out worth $25,000 and ends up being $908.29. Make no mistake about it, cars will lose you money, a lot of money. This is the main used car person argument - Why pay more for something that is continually going down in value?

#3: SALES TAX

[Austin, TX = 8.25%]

Obviously the more used a car, the less expensive it becomes. Therefore, the less you pay in sales tax.

#4: INSURANCE

[Quotes from Progressive.com]

The brand new and 5 year used price for insurance includes comprehensive and collision. Notice there is a drop with the 10 year price because when a car hits it’s 10 year old mark the insurance company recommends only having liability insurance, no collision. This is because the car is no longer worth a lot of money so it makes sense to lower the amount of collision coverage. The 15 year old and 20 year old price also includes no collision insurance. However, notice as the car gets older insurance rates actually go up slightly because the newer the car the better the safety features. Or perhaps, in my opinion, insurance companies assume people that drive old beater cars are more likely to mishandle their car and crash it.

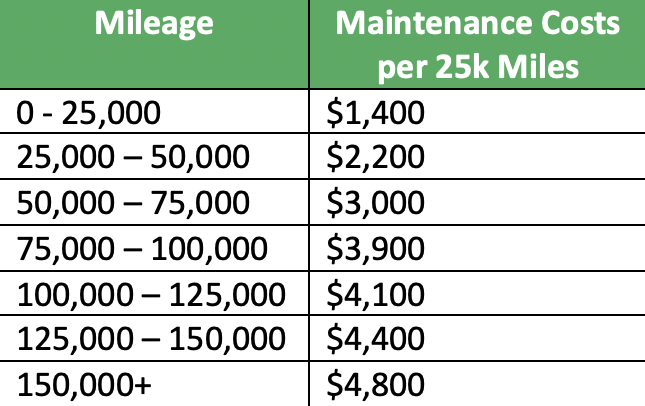

#5: MAINTENANCE

*Based off the number of miles the average person drives per year = 13,500 miles*

This is the hardest factor to provide concrete data for. Due to the fact some cars get lucky and never have issues and others break down the first month. Also, it depends of the make and model of the car. However, the most accurate and inclusive data across the board resulted in these points:

Based off the data above we get the following calculations:

The old used car is almost 3 ½ times more expensive to maintain then a brand new car. This is the main new car person argument; t’s the high maintenance costs… it’s the peace of mind!

#6: FINANCING

In 2020, 84.2% of new vehicles purchased were financed.

If you have a credit score of 750+ the average interest rate a person got this year was 4.65% for 60 months. That means on a new $25,000 car you pay $3,080 in interest over the course of the loan, meaning the car actually cost you $28,080.

RESULTS

Can you buy a slightly used car and avoid the high amount of depreciation a new car goes through and still avoid the high maintenance cost an old beater car has? I was really hoping to find some crazy, niche formula where if you bought a slightly used 6 year old car and kept it for 4 ½ years that would be the cheapest option. I’m sorry to inform you that is not the case. I did every formula imaginable and every time the more used/older the car and the longer you kept the car = the cheaper the car would end up costing you over the course of its life. Even though used cars have up to 3 ½ times more maintenance costs! Check out the numbers broken down below.

What Does This Mean?

I’m not saying never buy a new car. What I’m saying is buy the car you can afford. If you are trying to justify a new car purchase because its lower maintenance costs, check the math. The depreciation will still get you. Personally, I don’t really care how my car looks as long as it’s an SUV and my commute to work is only 10 minutes. Therefore, I drive a 14 year old car with a 250k+ miles on it. My car equals approximately 2.5% of my yearly salary. Am I ever going to drive a new car? Yes, one day I’m going to drive a car that’s worth $100,000, but that day is just not today. And when that day comes my salary will justify driving a $100,000 car.

If your household income is 50k a year and you own two cars worth $25,000 each, those cars equal 50k, in other words 100% of your salary. Now obviously you are not spending 50k every year on cars but that comparison is good to look at for principle. Stop just looking at the monthly payment the dealer offers you (Ex: $350/month, “Oh yeah we can afford to do $350/month). Add up the what the car is actually going to cost you in the long run and compare it to what you make. You probably don’t make enough to buy the car you really want… yet. But it’s a math equation, when your income goes up 10% you can afford to drive a 10% nicer car and so on.