How Much Do You Need To Retire?

How much do you need to retire? The sooner you start retirement planning the easier it will be. In this article I will give you a simple formula to calculate exactly how much you need. Retirement is not an age, retirement is a number.

According to the CDC if you make it to age 60, you are then expected to live to age 83.3. Which means you have another 23+ years where you have to live off of the money you have saved. And if you want to retire earlier you're going to have to live longer off of the investments that you have. But that doesn't mean you need more money.

The way you know you can retire is when your investments replace your income. Your investments being your 401k, businesses, real estate, social security, pension, IRA, etc. The sooner those things bring in income that replaces your current working income, the sooner you can retire.

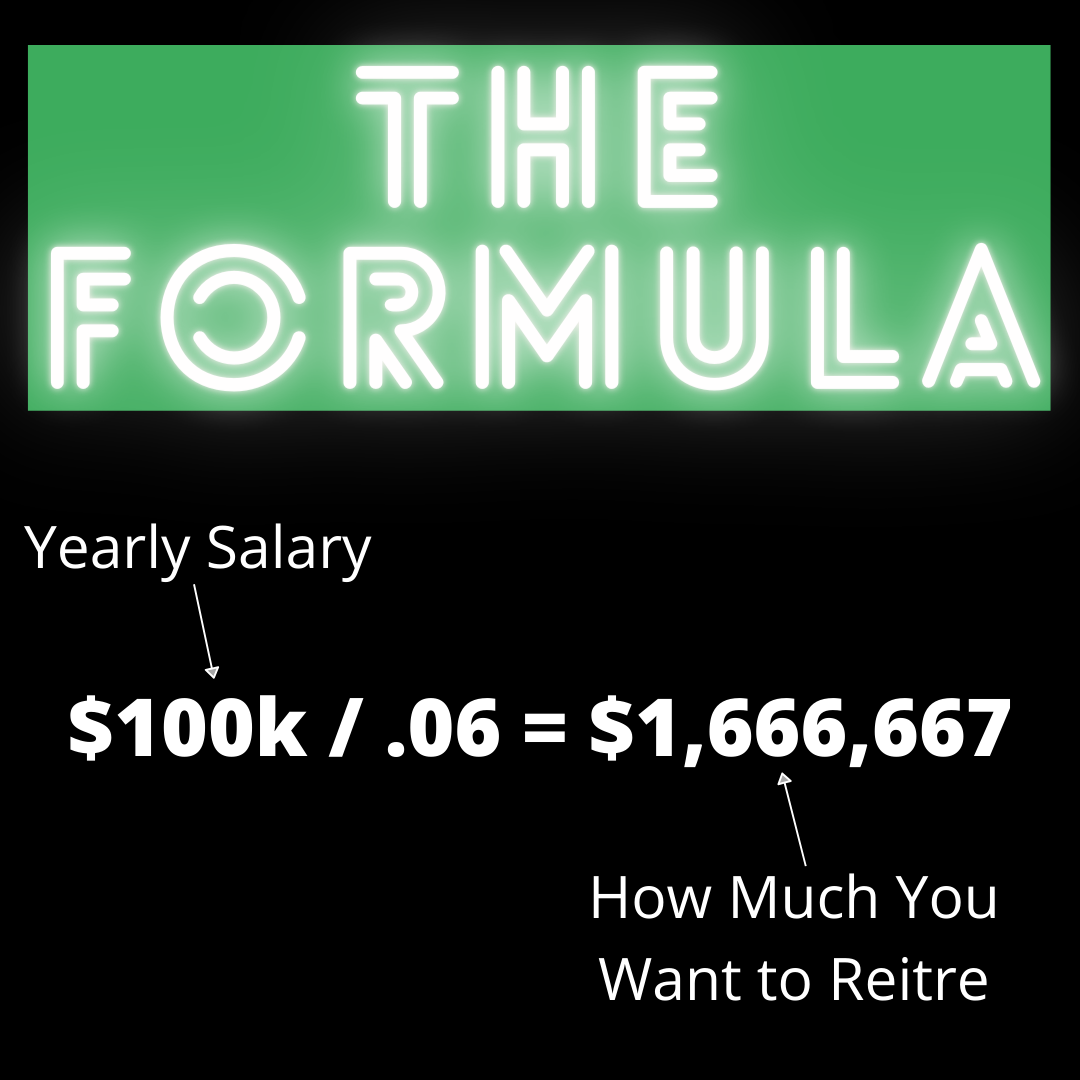

THE FORMULA

Take your yearly salary and divide it by .06. So if you make $100k per year, take $100k / .06 and you would need = $1.66 million dollars to retire and replace your current income. If you don't feel you'll need to fully replace your income when you retire and there is only going to be a certain amount of living expenses you're going to have to pay for… Then just take whatever your living expenses are per year and divide it by .06. For example; you need $50k to live off of per year in addition to a pension or social security. Take $50k divided by .06 and you would need = $833k.

THE 6% RULE

But why does this formula work? It's based off of the concept that you're going to withdraw 6% a year off of your nest egg. What's a nest egg? For example you have $1 million in a 401k. The million dollars is your nest. That $1m stays invested for the rest of your life and you live off of the interest that the $1m brings. The stock market does a little over 10% per year on average. Therefore, that $1m will bring in a bout $100k of interest every year. Now we don't want to take out the full amount of money that your nest egg is bringing in because you have to account for things like inflation. Which on average has been 2% to 2.5% per year. So you don't withdraw the 10%, you withdraw 6% to account for inflation and stock market fluctuation. Some people who are more conservative will withdraw 4% per year and some people who are more aggressive will withdraw 10% per year. I recommend 6% because it's conservative enough your nest egg will continue to survive the rest of your life and it's aggressive enough that you can actually live off and enjoy the money you saved.

THE FORMULA (MONTHLY)

If you want to take the formula and look at it on a monthly basis here is how you calculate it: Take however much monthly expenses you have and divide it by .005. So if you need $4,000/month to live off of... take $4k divided by .005 and you would need = $800k in your nest egg to retire.

This is why retirement planning isn't about an age (60, 65, 70), it's about a number. Whenever you hit the number you need that is when you can retire no matter how old you are. Side note: if you are thinking you will retire before age 59 1/2 you want to have money in more than just IRA’s and 401k’s because those have the age limit of 59 1/2 before you can withdraw the funds. The solution… open up a brokerage account in addition to your other retirement accounts.

WHERE TO START INVESTING

If you're not sure where to even start investing you can click this link here and I'll walk you through 6 different places for you to start investing. If you hear these numbers such as $800k and $1m and you think that is too impossible for me to ever have that much… You're wrong, it's actually very easy. If you're 25 years old and you invest $250/month from now until age 60 you'll retire with $1m! It's really not hard if you just start investing now, like today... like right now! It's all about taking advantage of compound interest. And if no one has ever taught you about that and how to use compound interest to your advantage you can watch this video here about the power of compound interest and how it separates those who are wealthy and those who are broke.